Are big game franchises dying?

While the gaming industry grows larger and more profitable every year, we’re seeing fewer and fewer of our favorite franchises' prime days. Baldurs Gate 3, a new installment in a smaller series, came out to great acclaim and success, whilst games like Call of Duty: Modern Warfare 3 come with an AAA price and in-game purchases to a resounding “meh” from fans. So, whilst publishers continue to chase recurring revenue; are big franchises dying? After all, why bother pumping a load of money into a game, when you can make it a service and update it as you go along?

Source: COD:MW 3. oneesports

We’ll be trying to answer these questions in this article as we analyze major franchises. Along the way, we’ll look at several parts of the industry and try to understand what’s working in gaming right now, what isn’t and why are certain series doing well whilst others are slowly becoming obscure. To begin, our journey sets off where most things in business set off.

Finance

AAA games today are more expensive than ever to develop, between graphics being pushed harder with diminishing returns and the chase of ever-bigger worlds, costs are increasing more than ever. You need more developers if you want to make more game, and more developers cost more money. And we do mean, more money, according to The UK Competition and Markets Authority’s report on the Activision-Blizzard and Microsoft merger, the cost to develop 2023’s Call of Duty was as high as $300 million excluding marketing costs.

That’s already a very high amount of money for a yearly franchise and like we said, that’s not even adding marketing costs to that amount. For context: those tend to be as high as the budget for the game itself, judging by the historical numbers for the franchise also in the report. That means that before any copy has been sold, $600 million has been spent on the newest COD game. Reminder, a yearly release franchise. Suddenly, a few things start to make a lot more sense.

Publishers are no longer in a position where just selling copies of their game easily achieves the profit margins demanded by shareholders, even if they are smash hits. To be truly profitable to their investors, there needs to be recurring revenue for them. Why sell something once when you can keep collecting money? This is how we’ve ended up in a position where games can be fully priced, yet charge for things like skins.

Budgets get overinflated, so to make that okay monetization needs to be much more aggressive.

But wait, smash hit Baldurs Gate 3 “only” cost a rumored $100 million minus advertising, yet has no monetization and has absolutely slayed. According to VG Insights BG3 has grossed over $555.9 million on Steam alone. So for some studios, it’s possible to make a profit in gaming without monetizing every aspect of it. You’ll see us use BG3 as a measuring stick throughout this piece because it’s a shining example of modern game development.

This exemplifies the exact dividing line for major AAA franchise releases in 2023. Some, especially those developed by big AAA Publishers like Ubisoft and Activision-Blizzard-King, are heavily focused on monetization. They will charge for the game, then for currency in the game. In the case of COD, having the multiplayer mode be heavily monetized but leaving the story alone. On the other hand, there’s the complete opposite: Complete narrative experiences that charge you for entry and pat you on the back when you’re done. Look at Cyberpunk as a recent example, their only additional monetization has been the release of DLC, which has been critically acclaimed on its own merit.

So, whilst finances tell us why these franchise games do what they do, they also show that it is viable for big games to be profitable. Clearly, there’s more to what’s going on with games than money. So, let’s start by taking a look at a few franchises and seeing what lessons we can get from them. If any.

Assassin’s Creed

Assassin’s Creed is probably the quintessential example of a long-running singleplayer franchise. Which makes it uniquely qualified to be used as a time capsule of sorts. By looking at how this franchise has changed over time, we can see what trends have entered gaming. In terms of gameplay, but also in terms of monetizing games, Ubisoft isn’t shy of making money.

Let’s go to the beginning:

Starting in 2007, Assassin’s Creed has been pretty much ubiquitous throughout the modern era of gaming. If you started gaming in the 2000s or later, odds are you either played or know someone who’s played an Assassin’s Creed game. And that’s in no small part due to just how quick their turnaround has been with this series. There have been 12 “main” Assassin’s Creed games, bringing us to an average of 1.3 years per game.

It makes sense that Ubisoft wants to keep it moving, especially in the early days. You can reuse quite a bit of work done on the previous game, and charge a full $60 at release with minimum fuss from the consumer. So long these games are quality, no one will complain, and rightfully so.

But, a game almost every year isn’t exactly prime innovation conditions. So, we’ve seen this franchise use its gameplay elements over, and over, and over again. Whilst the core idea was innovative and inspired many games, like the Arkham series, recycling the same gameplay loop with fairly little time between games has disengaged fans for years. The only real innovation the series saw was by adding boat travel to Assassin’s Creed IV: Black Flag which to this day is still held in high regard and is commonly hailed as the best game in the series.

As the franchise started heading into its fifth, sixth, and seventh installments, the cracks started showing. Rogue, the fifth game in the series, was the first game to drop below 80 on Metacritic. Unity, the sixth, was notorious for its broken launch, having no lack of glitches, bugs, and a general lack of polish. The rushed cycle between games was taking its toll on the quality of the product. That wasn’t even all the game did that caused controversy, it was the first game in the franchise to introduce in-game purchases.

Source: Polygon

The game offered Helix Credits, which you could exchange for general progression items, like armor, weapons, and even map hints. A low-intrusion way to monetize your game, at least compared to what many other games have done. It’s entirely optional after all. But, this must’ve worked well enough for these purchases to become a mainstay in the series hereafter.

It was such a success in fact, Ubisoft changed its approach starting from Assassin’s Creed: Origins, ushering in “Phase Two” as they call it. This changed their design philosophy ever so slightly, you still get the same gameplay ideas but with more RPG elements added to the game. As well as the introduction of “Live Service elements.”

This means Ubisoft doesn’t need to develop a whole new game to get your money, it can just release new content and charge a fee. That doesn’t mean microtransactions are out of the game either. You can still pay to make the game easier. So long they’re optional, that’s far from the worst thing.

We might say something a tad controversial here, but this has been a good thing, at least at a surface level.

The ability to monetise sold copies has allowed Ubisoft to take more time between installments. So it’s no surprise that all the most recent “Phase Two” games have been the highest rated in recent memory, by critics. And it’s not just because they brought back the boats from Assassin’s Creed 4. The problem with the AC games from Origin onwards has been user reviews, those haven’t changed. People are still tired of the gameplay loop, despite its attempts to reinvent itself. That’s this franchise's biggest problem. It cultivated indifference. 2023’s Assassin’s Creed Mirage, a flashback to the earlier titles in the series, has been the best-grossing game for Ubisoft on the new generation of consoles, yet it’s been mostly forgotten already. It’s not had the same cultural impact as many other games that have come out this year, being overshadowed in discussion even by the mediocre Starfield.

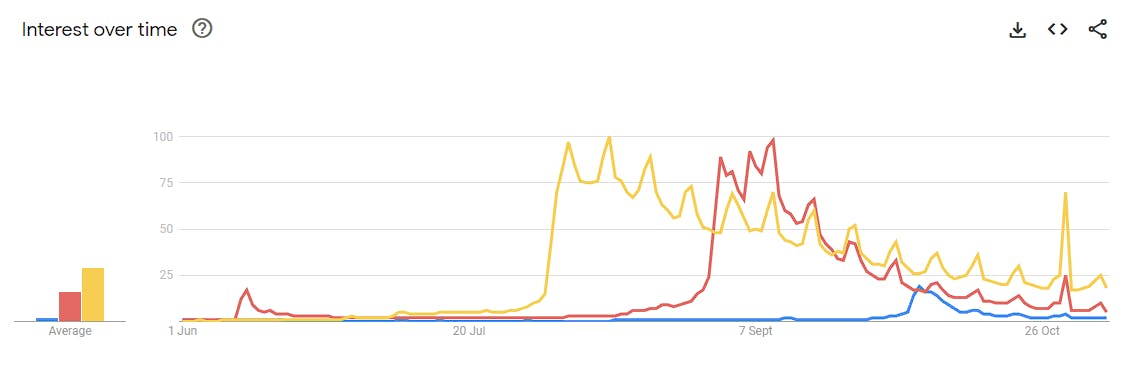

Source: Google trends for Baldurs Gate 3 [Yellow] Starfield [red] and Assassin’s Creed: Mirage [Blue]

Overshadowed is even a kind way to describe just how irrelevant this release has been, and it’s a big problem for Ubisoft.

Indifference is the most dangerous thing to a live service model, if no one cares, no one will spend money on it. If no one spends money on it, investors will quickly question if it's wise to keep putting money into an IP that doesn’t make a return. That is how franchises come to an end, not with a bang but with silence and indifference.

Don’t just take it from us though, Ubisoft themselves have clearly seen the need for change as they’re taking us into “Phase Three.” We have no idea what this will entail really, but series executive producer, Marc-Alexis Côté says it’ll be a “new design philosophy” for the franchise. And we do hope they change it up, as the series needs it. A large change can revitalise a whole IP, and there’s no better example of it than:

God of War

The poster child of a series re-inventing itself: God of War. Starting back in 2005 on the PlayStation 2, God of War was a hack and slasher set in Greek mythology letting you take control of Kratos. You were there to take revenge in the most violent way possible.

For all intents and purposes, this franchise was nothing but pure fun. There was obviously a story to motivate you, otherwise, what's the point, but that wasn’t the main attraction. You were there to kill gods and do it well. And people liked it, which is why the first two games in the franchise sold a combined 8.86 million copies, a resounding success for a new IP, even if developed by a Sony studio.

This success led to two PSP games which used the series success to try and generate interest for the handheld console. As well as a third mainline game that outsold both the originals and finally the prequel God of War: Ascension. A game that tanked so hard that it’s the only one in the franchise whose sales are measured in thousands, not millions. Yes, even including the PSP games.

So, Sony got the hint and shut down shop with Kratos. Between 2005 and 2013, Sony got all the hack-and-slash adventure they could of Greek mythology, and it left fans satisfied. It’s rare a franchise ends at the right time for people not to get sick of it, but here they nailed it.

But then, 2018 came about and God of War, the reboot, was released.

This was nothing like the God of War we had seen before, it was set in Norse mythology, not Greek and this wasn’t just a hack and slash. This was a narrative RPG with an engaging story, the kind Sony had developed a reputation for producing. It had shown success with The Last of Us and Uncharted, and re-introducing a previously existing popular IP with this style was a brave move. But, it was also a MASSIVE success, God of War (2018) outsold the entirety of the franchise that came before it. (excluding re-releases) It was another example of the sheer success these narrative singleplayer games were and are having in the industry today.

Source: God of War [2018]. Cnet

Sony took a franchise that was one, very defined genre, then completely changed it up years after the IP’s heyday was over. It became one of the most successful releases of the Playstation 4 era, becoming an influential part of gaming culture since its release. It was so popular and culturally significant, that Sony brought it to PC because they knew it would be a success on there as well, and they were right.

This story is the shining example of franchise reboots done right. It’s innovated on itself and become a fresh new take, not just a way to extract more milk from a cash cow. It’s a positive thing for the industry that God of War: Ragnarok, the follow-up to GoW (2018) is a success as well. Consumers vote with their wallets, so seeing the success of high-quality, self-contained, games is a great sign.

But what does this mean in the larger picture?

Analysis

Now, whilst we could spend all day looking at franchises and still miss 70% of them, that’d be missing the forest for the trees. We now have two examples of pretend innovation with rushed releases, and one where a studio took its time and really changed things up. With this alone, we can now take a look at the wider industry as a whole, what’s doing well, and how this bodes for your favorite franchise. Because we’ve still not answered the question in the headline.

There’s no better way to gauge what’s doing well than looking at sales, the measuring stick for success in the industry. Are these still dominated by big IPs, or are new titles breaking through into the best-sellers list?

When we look at the best-selling games this year, as of September 25, 2023, insider gaming reports Hogwarts Legacy takes the number two spot. With Diablo 4 in third, Starfield in fourth, and Resident Evil 4 remake in fifth. Hogwarts Legacy might not have been part of a game franchise before, but its close relation to an already popular IP is a little unfair for comparison. It might as well be part of a franchise when Harry Potter is the phenomenon it is.

The point though is that most of the top-selling games do to some extent belong to a franchise. Diablo 4, and Resident Evil 4 are obvious examples. Starfield might not be a franchise by name but has the “developed by Bethesda” moniker, which brings the same familiarity and trust as being a follow-up to one of your favorite games. What are Bethesda games if not the same game in different settings?

We can take some information out of this. For one, This list proves to us that with enough brand power, anything can sell. Diablo 4 has been universally panned for its business practices, yet has sold exceptionally well. Starfield has been a critical minefield, with most people agreeing it starts off fine but gets dull fast. Whilst Hogwarts Legacy has its own can of worms that’s far beyond the scope of this article.

We can only conclude that gamers are still rewarding mediocrity so long it’s a brand they trust, showing us that in essence, no, franchises aren’t dead yet. But don’t click off just yet, there’s more to say. Because at least the trust for these specific franchises isn’t dead yet, these specific games are examples of what has done well this year. But somehow that doesn’t entirely answer our question, because you might have noticed we left out the best-selling game of the year.

Number one was Legend of Zelda: Tears of the Kingdom. This gives us an opportunity to take a look at a company we’ve not mentioned yet but can give us an insight into the industry.

Source: Tears of the Kingdom Promotional art. Nintendo

Nintendo

You can’t have a conversation about franchise success and leave out Nintendo. The giants have built their brand on the success of their franchises dating back all the way to Super Mario Bros on the NES. Since then they have become a powerhouse of the gaming industry, with Mario being the almost de-facto mascot for Video Gaming.

The success of Tears of the Kingdom shows just how much of a difference quality makes, it outsold several massive multiplatform games whilst being exclusive to the Switch. It’s a franchise done right because its name is more than recognition, it’s a sign of quality. When you see a Mario or Zelda game you almost assume it’s good, because the quality of both series has almost universally been great across the board. Even if there are notable exceptions.

The reason Nintendo hasn’t been mentioned before up till now is honestly because they’re almost their own industry. They seem mostly unaffected by trends as they continue to do their own thing, for better or worse. They’re almost guaranteed sales with their fanbase, and anything they produce that reaches outside of their core audience is usually a wild success.

So much so that if every other franchise ended, Mario and Zelda would still be topping sales charts effortlessly. Seriously, Mario Wonder, a new approach to 2D Mario, came out and sold 4.3 million copies in two weeks. Publishers take note, quality pays off. Nintendo can get away with all sorts of bad practices so long they stay out of their games.

Source: Mario Wonder sales, Nintendo financial report

There’s a reason we separated Nintendo from the rest though. Nintendo as a company is its own ecosystem, financially they're beholden mostly to themselves and have historically been resistant to shareholder pressure. Most other publishers/devs simply don’t have that pleasure, they have targets to hit. Nintendo gets to take their time, develop, and invest without being pressured to add microtransactions to every game because only taking money once isn’t good enough.

Finances still run this industry, business is business, and we might not have covered that enough yet.

Finances (Part 2)

If you thought we were done discussing finances, we’re sorry to say you’re wrong. Unfortunately, this will be a downer.

So, we’ve managed to establish that franchises are still successful, so long you innovate. The failures of big IPs so far have all been based on a lack of new content, innovation, or oversaturation. Throughout this, we’ve praised quality narrative-focused games for being the cornerstone of the high-quality releases we’ve seen throughout the 2020s. Unfortunately, that has just been the present and past. Now we need to think about the future.

These games have a problem: They’re really expensive to make. Building an immersive world from scratch is a big investment, the amount of man-hours that go into building a world like Cyberpunk’s is immense. Those hours are all costs, not to mention the amount of money it costs to pay actors, do the motion capture, and translate that into a game.

The world is currently going through a rough patch financially, consumers are getting poorer through inflation with little to no rebalancing in their income. This then goes straight up to game companies that lose revenue and investment from other sources that have lost revenue themselves. If this goes on too long, there’s simply no space for these massive money sinks when a consumer can’t afford the game when it comes out anyway.

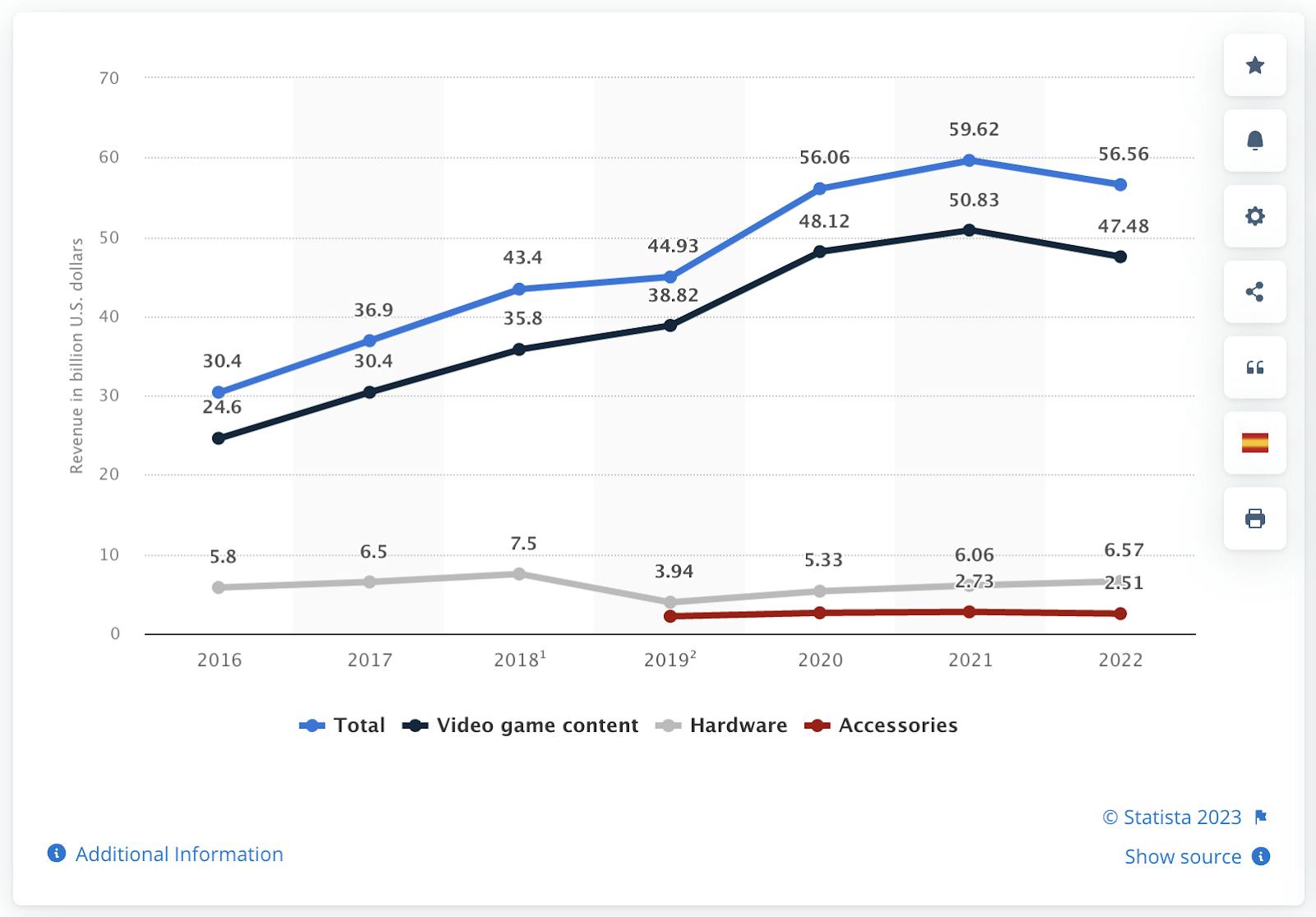

How do you justify building a massive immersive world to your investors when you’re losing money quarter to quarter and just need something to bring back revenue fast? This is a massive problem for the industry to overcome because there’s only so much money to go around and sales have already dropped since 2021 according to Statista.

Source: Video game sales, HelpLama

The worst part is that it doesn’t just affect these story-focused games.

Games supported by microtransactions, free or otherwise, will also see a massive tank. As disposable income goes down, it makes sense that less money goes into these types of games. What this does though is create a problem for AAA games as we know them today, most franchise games are either narrative-led, big-budget games or supported by in-game purchases and the live service model.

The second point might be seen as a positive, but this will have long-lasting effects on the entire market. These types of games are important revenue streams for these companies, subsidizing a lot of their other efforts. Losing them means we’ll go back years in terms of growth in the industry that we can’t guarantee will return. There are no long-term positives, even if the idea of losing these purchase-heavy titles is a tantalizing prospect on paper.

With these conditions, we might see a return to a market where smaller-budget games that don’t require much to break even are rewarded. Movies have gone this way as well, Blumhouse being the shining example of a studio making cheaper movies that all profit. Unfortunately, as it stands modern franchises simply do not fit in that model. Everything about these IPs has been growth-focused, both in terms of revenue and the game. Take a look at Assassin’s Creed, they’ve exclusively been focussing on growing their games. So much so that added microtransactions to a singleplayer game and then they switched genres midway through their franchise.

Scaling back isn’t something we’ve seen from the industry in recent times and it’s showing in the news. There are constant reports of layoffs, most recently in the news being those at Epic Games. This might only be the beginning.

None of this even gets into how shareholders might react to lower revenues. Shareholders have their hands all over companies, if they stop seeing returns investment will drop even more.

Conclusion

So, are game franchises dying?

Right now, no. Franchises as it stands are still driving massive sales, despite how sick everyone claims to be of them. We might be losing the old guard of game franchises slowly with Battlefield being dormant, Assassin’s Creed being at a low point and COD continually being stripped of the things that made it beloved. But despite that, new improved juggernauts of the gaming world are coming out and doing big sales numbers.

Nintendo has made a legacy for itself on this premise, being games that you know you will enjoy and selling an entire ecosystem around it.

But the future of franchises is far from certain. As budgets balloon to continue the trend of ever-expanding worlds and pushing the limits of technology, we reach a point of unsustainability. The period of growth in gaming might be over, and only time will tell us just how well the industry can cope with that. Call of Duty might need to stop spending hundreds of millions of Dollars on marketing and start saving money. Especially now Activision-Blizzard-King is owned by Microsoft, who must have a bit more sense.

This doesn’t mean franchises will truly be dead, name value still contributes. But we might need to get used to a new approach to gaming than we’re used to right now. What that is, we don’t know, this task is on very highly paid executives at publishing companies.

Enjoy the current state of gaming whilst you can, because you don’t know what you have before you lose it. Or we could be wrong, the financial situation could turn around and we could hit another golden age of gaming. As we’ve mentioned throughout, Baldurs Gate 3 is a shining example of a game done right in the modern era, and it’s different from the proven singleplayer experiences we’ve seen.

Even if we do end up in a weaker market, restriction breeds creativity. We’re hopeful that no matter what, gaming will give us great experiences and fun times.